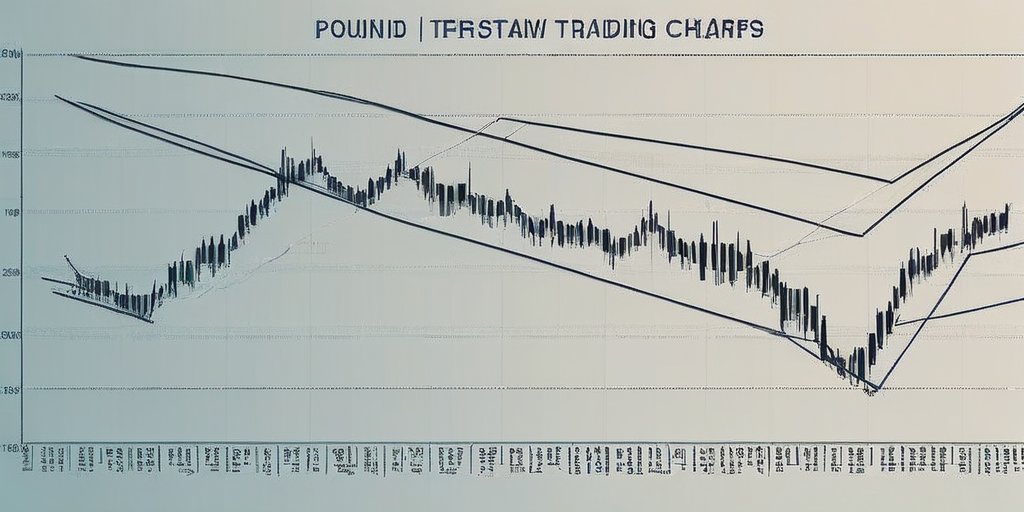

In a surprising turn of events, the British pound surged to its highest level against the U.S. dollar in nearly four years, reaching above $1.37. This increase comes on the heels of unsettling reports suggesting that U.S. President Donald Trump might accelerate the appointment of a new head for the Federal Reserve. The potential for change in leadership has triggered market jitters and a corresponding dip in the dollar’s value, reflecting traders’ concerns about the future of monetary policy under Trump’s influence.

Observations around the current economic climate indicate that Trump has been vocal about his discontent with Jerome Powell’s tenure as Fed Chair, labeling him “terrible”. The Wall Street Journal’s recent report, which suggested that Trump is considering replacing Powell sooner than expected—potentially by September or October—adds to the uncertainty. Powell’s term is officially set to end in May 2026, yet Trump’s call for a new appointment illustrates his ongoing tug-of-war with the Fed regarding interest rate decisions.

Concerns regarding Trump’s influence over the Fed raise important questions on whether the President may select a candidate who aligns more closely with his economic agenda. The Federal Reserve’s independence is crucial in nurturing trust in financial markets, particularly with regards to managing inflation effectively. Should this independence falter, the risk of increased borrowing costs might loom, which can put a strain on the broader economy.

As the U.S. economy has already shown signs of distress, contracting in the first quarter of the year—the first decline in three years—it is evident that any alterations in the leadership of the Federal Reserve could have significant repercussions. Trump’s retaliatory tariffs, set to take effect next month, are also anticipated to impact inflation rates, with Powell indicating that the Fed would monitor the economic fallout carefully.

Despite JP Morgan easing recession fears, they suggest a 40% probability of economic slowdown still lingers. Market strategists predict a growing dollar weakness in a climate where institutional faith appears to be dwindling. Financial analysts assert that confidence in the Fed’s operational integrity must remain intact to avoid challenges in stabilizing inflation and managing debt levels.